What is PORTFOLIO REBALANCING and Why is it Important?

Updated on 20-06-2020

Anything kept idle for longer period get distracted from their ultimate goal. Same happens with financial portfolio, it should be reviewed periodically and should adjust the allocation in asset classes based on the market situation, this exercises in investment portfolio is popularly known as PORTFOLIO REBALNCING.

A periodical portfolio rebalancing habit is beneficial in many ways, it adjust your financial risk and hunt for the opportunist instruments for fresh allocation.

Rebalancing of portfolio means selling nonperforming assets or funds and buying potential asset is regular exercise for successful investor, they do whenever market get overcorrected or overpriced or in situation when they face any turnaround in personal economical situation.

Example:

Say that you put Rs. 20,000 in Mutual Fund X (i.e Equity) and Rs. 20,000 in Mutual Fund Y (i.e Debt) in June 2020. Say at the end of June 2021 due to market forces, your investment of Rs.20000 of fund X (i.e Equity) gives a negative return of 14000 while fund Y (i.e Debt) gives you Rs. 33,000.

When you began your investment, both the funds had the same weight. At the end of 1 year, fund X (i.e Equity) dominated your returns and showed you negative return where as Fund Y (i.e Debt) gave you positive return at the same time.

How Portfolio Rebalancing works?

Primarily, portfolio rebalancing safeguards the investor from undesirable risks. It allows investor to line up their investment with their goals by periodically rebalancing their portfolio. Investors can move money from stocks into other asset classes, such as bonds and money market funds. If investors risk tolerance or investment strategies change, one can invest more in under represented asset classes until one achieves the overall allocations according to his/her want.

Check your portfolio allocation at https://www.giisfinancial.com/login.html (login required, add your products to check your portfolio allocation)

How can you rebalance your portfolio?

When you invest in mutual funds, you're primarily investment to attain one goal via numerous vehicles. Therefore after you rebalance, the shift should occur across all of those funds at identical time.

Here’s however you'll be able to rebalance your portfolio in certain simple steps:

Step 1: first you have to do an asset allocation set up by taking into thought your financial gain, the expected time of retirement, etc. produce an asset allocation framework, however if you're unsure you can speak to our professional –GIIS Financial can help you.

Step 2: Assess your current asset allocation by identifying wherever and the way your current investments are placed on stocks, cash, bonds, or the other sort of investment. Post these analyses build a comparative analysis of asset allocation target of its given state and accordingly make changes.

Step 3: Chart out a rebalancing set up is your asset allocation target doesn't align together with your current portfolio. This step of the rebalancing process can seem a bit intimidating where you have to decide which securities to keep and in what numbers. Speak to our consultants at GIIS Financial to induce clarity.

Step 4: Be mindful of the tax implications, particularly on capital gains. Avoid the short term taxes on capital gains by holding on to your equities for over a year. Just in case of debt funds, the short-term capital gains will qualify for taxes based on the individuals’ income tax slab. For long-term 3 years capital gains, the tax is 20 percent with indexation. If you need to scale back, aim to sell the securities in the tax-exempt accounts first. That way, you’ll limit the taxes you pay in capital gains.

Step 5: Review your portfolio at least once in a year or in 6 months to assess your position but rebalance it only when you feel that the allocations are significantly out of the track to reach the target.

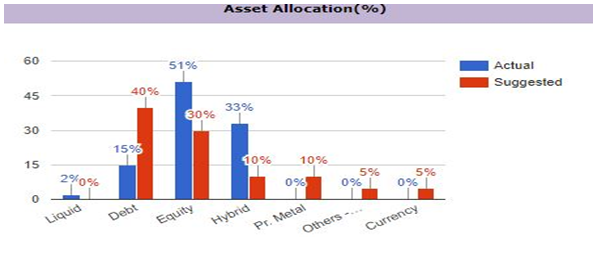

With the help of the graph you can find out the % of actual and suggested asset allocation:

In this graph you can see asset allocation is an investment strategy that aims to balance risk and reward by apportioning a portfolio's assets according to an individual's goals. There is no simple formula that can find the right asset allocation for every individual. By the help of GIIS Financial professional you can allocate your assets in liquidity, debt, equity, etc. in the right way as shown and attain your investment results.

What is the cost involved with Rebalancing your Portfolio?

There are certain expenses involved with rebalancing your portfolio and as an investor, you must be aware of those expenses:

a. The cost of brokerage and Securities Transaction Tax is one of the expenses you will incur as an investor. This includes the transaction cost of buying and selling securities like stocks and bonds.

b. Charges of exit load of about 2% in the case of mutual funds can be levied if you sell your investment within a particular time span.

c. Taxation on capital gains of 15% will be incurred by you on the sale of equity investments within a year. There will be a marginal tax rate for debt investments that you sell within three years

Rebalancing of a portfolio is more about identifying and implementing a system that works best for you as an investor. It must never be about simply adopting what works well for somebody else. At the same time, it also entails reviewing and making informed adjustments, keeping in mind the tax and other consequences.

If you believe that asset allocation is important to your overall returns then you are also compelled to rebalance your portfolio to achieve that desired vision. Although portfolio allocation may seem complicated at first, the strategy is relatively straightforward because you already know the thresholds your portfolio needs to hit. This will make the asset selection process much easier.

For further assistance in rebalancing your portfolio speak to us at GIIS Financial.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment