HDFC Mutual Fund First Global Scheme Investing Across the World

Updated on 23-09-2021

HDFC Asset Management Company has launched HDFC Developed World Indexes Fund of Funds, providing exposure to 5 regions across 23 developed markets countries including Europe, Japan, Canada and US.

The NFO (new fund offer), which opened on 17th September, will close on October 1.

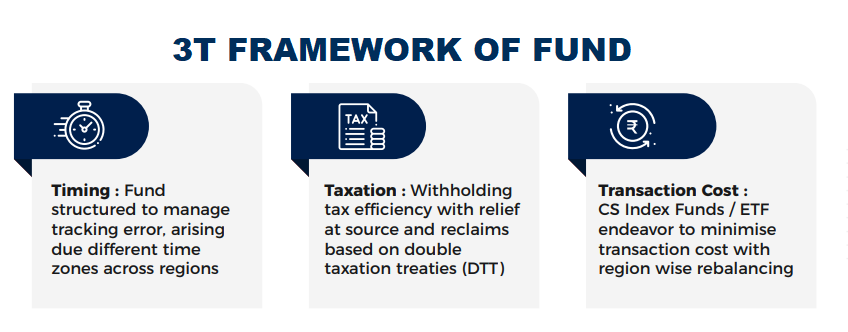

HDFC Developed World Indexes Fund of Fund is an open-ended fund of funds scheme that seeks to provide long-term capital appreciation by passively investing in units/shares of overseas Index Funds and/or ETFs, which will, in aggregate, track the MSCI World Index. The scheme has exposure to over 1,500 constituents and 14 currencies and will cover about 56% of global GDP and 50% of world market cap in one single fund. Minimum application amount is Rs. 5,000.

The Fund is suitable for investors looking to diversify and benefit from opportunities in the developed world. It is being launched in association with Credit Suisse Asset Management.

A passively-managed fund is a good way of gaining international exposure, as active fund managers have found it difficult to beat market indices in developed markets.

The MSCI World Index has shown lower volatility than the Nifty 50 across different time periods. HDFC MF has analysed pertaining to the last 20 years. MSCI World Index (14.3%) has also delivered higher returns than Nifty (11.8%) over the last 5 years.

Global diversification is important when it comes to building your equity portfolio and HDFC Developed World Indexes Fund of Funds aims to offer just that. MSCI World Index has a low correlation with the Nifty 50, which is what investors need to look for when diversifying their portfolio. Investors looking for a less-volatile option can consider deploying their surplus in HDFC Developed World Indexes Fund of Funds.

.png)

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment