SBI Balanced Advantage Fund NFO

Updated on 12-08-2021

SBI Mutual Fund has launched SBI Balanced Advantage Fund. The scheme which would dynamically invest its assets in equity and debt securities.The New Fund Offer (NFO) starts today i.e 12th August 2021 and will end on 25th August 2021.

The scheme’s investment objective is to generate long-term capital growth by dynamically investing its assets in equity and equity-related securities along with debt and fixed income securities.The fund would track CRISIL Hybrid 50+50 – Moderate Index TRI.

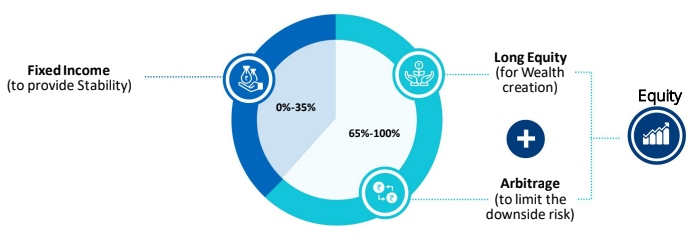

The fund will be investing a minimum of 65% of its assets in equity and equity-related securities and up to 35% of assets in debt and fixed income instruments. The fund allocates its assets in a combination of equity and debt and can invest in any companies across the market capitalizations & sectors. The fund aims to give long-term capital appreciation along with stability.

The scheme would invest between 0% and upto to a maximum of 100 per cent investment in equity and equity-related instruments. It will also invest minimum 0% to 100% investment in Debt securities (including securitized debt) and money market instruments.

The fund also provides a Systematic Withdrawal Plan which ensures regular cash flows by selling of units accumulated by investors at pre-specified intervals with designated percentage.

The minimum application amount (during the NFO period) required is of Rs 5,000 and in multiples of Re 1 thereafter. The Fund Managers for SBI Balanced Advantage Fund are Dinesh Balachandran & Gaurav Mehta for Equity portion, Dinesh Ahuja for Debt portion & Mohit Jain for managing overseas investments.

Who Should Invest?

This scheme is suitable for investors who are interested in long-term capital growth with an investment horizon of 5 years & above and want to invest in a mix portfolio of equity and debt.

The fund will help investors fulfil their asset allocation needs, and is suited for risk-averse investors who are looking for long term wealth creation amid volatile market situations.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment