Tata Business Cycle Fund NFO

Updated on 20-07-2021

The economy undergoes a series of phases such as expansion, slowdown, depression, and recovery. A business cycle takes place due to economic changes. Business cycle mutual fund invests in companies across various sectors by taking advantage of the changing economy. These types of funds identify the trend in the economy and invest in stocks, which will prospectively outperform.

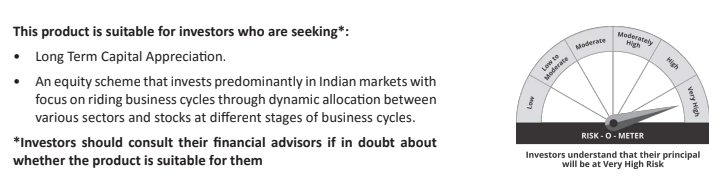

In line with this, Tata Mutual Fund has come up with Tata Business Cycle Fund NFO which will close on 30th July 2021. It is an open-ended equity scheme investing with a focus on business cycles through allocation between sectors and stocks at different phases of the business cycle. The objective of the fund is to create long-term capital appreciation.

The fund aims to deploy the business cycle approach to identify economic trends and invest in sectors and stocks that are likely to outperform.

For example, during periods of expansion, the Scheme would aim to predominantly invest in stocks of companies in the cyclical sectors as they tend to outperform the broader market during the expansionary phase.

.png)

Similarly, during the period of contraction the Scheme would look to invest in defensive sectors or sectors that are less sensitive to changes in overall economic activity.

The scheme is benchmarked to the Nifty 500 Total Returns Index (TRI) and will be managed by Mr. Rahul Singh (equity), Mr. Murthy Nagarajan (debt), and Mr. Venkat Samala (overseas). The scheme is allowed to invest up to 20% of its corpus outside India.

Compared with other diversified funds, the business cycles theme allows greater sector concentration in terms of sector over/underweight. The other portfolio parameters such as portfolio churn, market cap allocation and number of stocks will be dependent on the stage of the economic cycle, the release from Tata Mutual Fund added.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment