SBI Multicap Fund NFO: The Power of Diversification!

Updated on 14-02-2022

SBI Mutual Fund, which is the country’s largest asset manager has launched its Multi-Cap fund, an open-ended equity scheme that will invest in a mix of best ideas across large, mid, and small-cap companies.

The new fund offer opens today i.e. 14 February and will close on February 28.The fund is benchmarked against Nifty 500 Multicap 50:25:25.

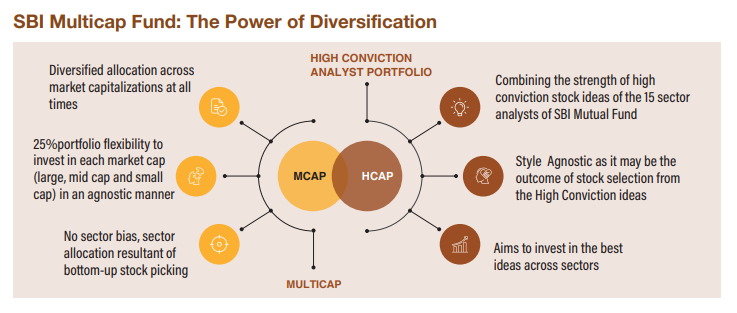

SEBI rules state that a multi-cap fund needs to invest a minimum 25% each in small-cap, mid-cap and large-cap stocks. However, SBI Multi-cap Fund would be investing 27% in each of these market caps. The remaining will be at fund manager’s discretion. Ruchit Mehta, head of research at SBI MF says that the additional 2% (instead of 25%) is to have a buffer against market volatility.

The fund will not have any sector or style bias as the outcome of portfolio selection will be based on the analyst recommendations. SBI Multicap Fund will not construct the portfolio based on index weights. The portfolio will capture stock investment ideas that will be captured through the analyst research. While the fund will be managed by R Srinivasan, who is the head-equity at SBI mutual fund, the fund will build the portfolio from the high-conviction ideas of its team of 15 sector analysts.

The fund also offers MITRA SIP feature, which will let investors invest through a Systematic Investment Plan (SIP) and simultaneously register a Systematic Withdrawal Plan (SWP) which will be activated at the end of the SIP period to generate tax-efficient regular cash flows.

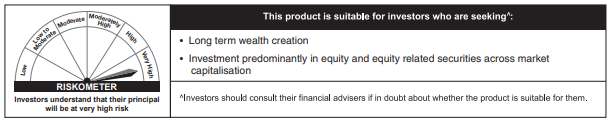

We believe Multicap Funds are an ideal investment option for investors who would like a mix across market caps as they provide exposure to all market segments within the same portfolio and growth potential while getting the benefit of limiting downside risk.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment