Have you analysed Risk and Return your Portfolio?

Updated on 25-07-2020

Construction of an optimal portfolio is an important objective for an investor. Several factors and investment characteristics are considered during the construction of the portfolio. The most important of those factors are risk and return of the individual. Creating a portfolio for an investor requires understanding of the risk profile of the investor.

A portfolio is composed of two or more securities. Each portfolio has risk-return characteristics of its own. A portfolio comprising securities that yield a maximum return for given level of risk or minimum risk for given level of return is termed as ‘efficient portfolio’.

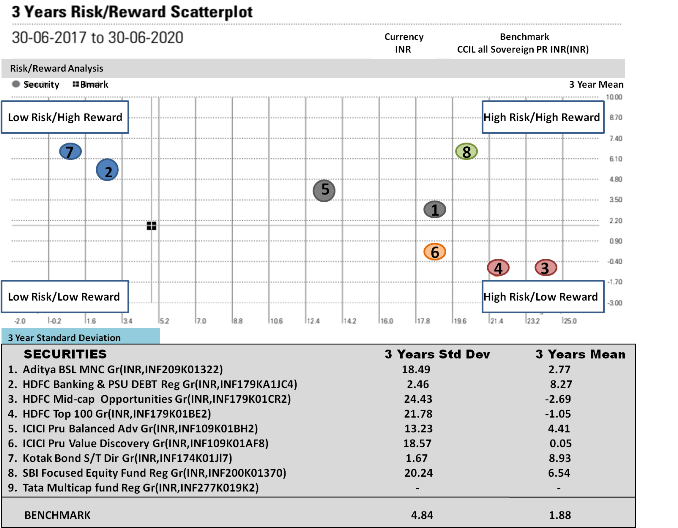

You can analyse your Risk and returns of the investments by a Scaterplot offered by your fund manager, where you can visualise average returns against the portfolio volatilities.

*Source of Data : Morningstar

In this graph you can see the risk and reward of the investment. It will help you identify which items are performing well (or poorly) for the amount of risk being taken.

The graph shown above is for 3 year comparison period, starting from 30-06-17 and ending on 30-06-20. You can see that some of the investments show high return for high risk, meanwhile in the same time period some investments were underperforming for the amount of risk being taken.

Each point in the graph represents the standard deviation and mean returns of the holding of 3 year investment period along with benchmark.

There are 9 securities in the portfolio all total. Among which securities 7&2 has given maximum return with lowest amount of risk taken.

Security 8 has shown high returns with high risk taken. Whereas securities 5, 1&6 have remained stagnant throughout the time period.

But securities 4&3 have performed negatively and have given negative returns with high risk taken.

Conclusion:

If the performance of certain funds in your portfolio has been negative for long term (say 3 years or more) investor should either switch over from the particular fund category to another category or exit from those funds and add new fund to the portfolio to enhance the portfolio value on a whole.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment