Balanced Advantage Funds

Updated on 18-09-2020

Unlike most categories laid out by SEBI, Balanced Advantage Fund or Dynamic Asset Allocation is a go-anywhere mutual fund category.

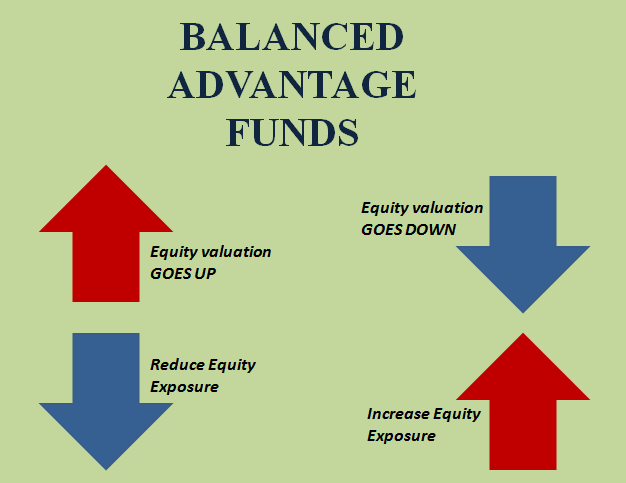

Balanced Advantage Funds has started gaining popularity over the last 3 years. These are dynamically managed equity mutual funds that typically alter their equity allocation between 30% and 80%, depending on market valuations and usually considering the price-earnings ratio.

The assets in such a fund are managed between equity and debt.When valuations are high, they increase their allocation in debt, reduce their equity allocation and when valuations are low, they increase their equity allocation with no restrictions. (The scheme information documents of some funds impose limits but these are extremely liberal.)

The Advantages

Balanced advantage funds come with the advantage of moving between equity and debt. In addition, they are also marketed as having lower risk than pure equity funds, but with the potential to give higher returns than pure debt funds while being classified as equity funds for tax purposes.

These funds can use futures and options (hedging) to reduce equity exposure to 30-50% or even lower while maintaining a gross equity exposure above 65% by giving the investors the benefit of equity taxation.

For whom is it suitable?

Moderate Investors who are willing to take less risk than pure equity fund and want to avail capital gain benefit of equity fund for tax advantage, can go for balance advantage fund.

Should you invest?

Not all balanced advantage funds use hedging and, hence, you should check the fund’s portfolio first and then invest.

Here we have some handpicked funds for you where you can invest:

*Data as on 15th September 2020

A pure debt-equity split may look rigid but it has the advantage of simplicity. It also has comparable tax benefits even with equity less than 65% if held for more than 3 years.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment