BULL RUN OF SMALL CAP FUNDS

Updated on 14-03-2020

What are small cap mutual funds?

Small cap mutual funds are equity mutual fund schemes which invest at least 65% of their assets in small cap stocks. SEBI categorizes 251st and smaller companies by market capitalization as small cap companies. Small cap companies are smaller than midcap and large cap companies in terms of market share, revenues and earnings per share. While small cap stocks tend to be more volatile than large and midcap stocks, but they have the potential of giving higher returns in the long term.

Small cap stocks can turn in multi-baggers

Small cap stocks in your portfolio can significantly boost long term portfolio returns and create wealth. Small cap stocks are mostly under-owned by institutional investors. Price discovery of such stocks tend to take much longer time than large cap and midcap stocks. This enables fund managers identify quality small cap stocks with high growth potential at very attractive prices. Over a period of time, if the stock performs well, it will attract the attention of institutional investors and valuation re-rating of these stocks will take place resulting in considerable wealth creation for investors.

In fact, most multi-bagger stocks (stocks which give several time returns e.g. 2X, 5X, 10X etc.) are small cap stocks. Out of 13 stocks which gained more than 100% on the Bombay Stock Exchange in the last 1 year, 8 were small cap stocks. However, identifying quality cap stocks requires considerable expertise and extensive research. The best way to invest in the small cap stocks is through mutual funds.

Why should you invest in small cap funds?

- Historically, quality small cap stocks have delivered stronger earnings growth than large cap stocks. Hence, price appreciation potential of such stocks is much higher

- Small cap stocks have low institutional ownership and tend to be under-researched. This provides fund managers attractive opportunities to generate high alphas

- Many industry sectors do not have large cap representation. While market size of such sectors may be smaller than large sectors, there are high market growth opportunities for such sectors and for the small cap companies in them.

- Institutional (both FII and DII) ownership of small cap stocks is likely to grow further in the future. This will enable small cap fund managers deliver superior returns in the long term

- SEBI’s market cap mandates for large cap, large and midcap, multi-cap, midcap funds and hybrid funds provide considerable opportunities for fund managers to add small cap stocks in these schemes in the future to boost scheme alphas. This can have favorable price impact for small cap stocks and funds

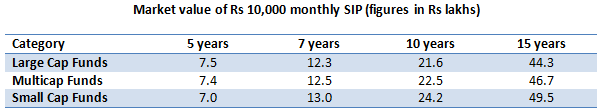

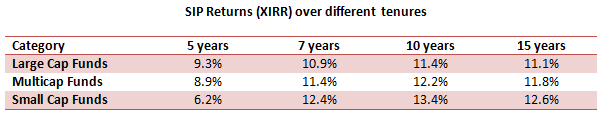

Small cap funds have been the biggest wealth creators over long tenures

The tables below show the growth of Rs 10,000 monthly SIP in various fund categories and annualized returns Extended Internal Rate of Return (XIRR) over different investment tenures. Category average returns are considered. You can see that small cap funds have been the biggest wealth creators over long investment tenures. Investors need to have high risk appetites, have disciplined investment approach and long investment tenures (at least 5 years or longer) to get the best results in small cap funds.

Investors should not expect quick recovery and should be prepared to remain invested over long tenures. We think that, SIP is the ideal mode of investing in small caps, but you can take advantage of the deep correction by investing in lump sum as well. You can consult with GIIS Financial advisors for further guidance.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment