ARE DEBT FUND ALWAYS SECURED?

Updated on 10-04-2020

Open-ended mutual fund schemes that predominantly invest in fixed-income debt securities are known as Debt funds. The underlying assets comprises treasury bills, government bonds, certificate of deposits, debentures, corporate bonds and various other money-market instruments.

Debt funds are one of the safest investment instruments available to investors, who wish to earn optimal returns on their investment, without betting on risky avenues. Also, the returns are quite stable, as opposed to returns from equity funds which are highly volatile.

Accrual Funds Vs Duration Funds : Where to Invest?

Debt Fund Investors are usually confused as whether to go for Duration-based funds or funds with Accrual Strategy. Let’s understand the basic of the strategies

ACCRUAL BASED STRATEGY

Accrual Funds ideally focus to earn interest income in terms of coupon offered by Bonds. The funds which follow accrual strategy generally buy short term instruments and prefer to hold till maturity, this reduces the interest rate risk. Corporate bond funds invest in high yielding corporate bonds which have a shorter maturity period.FMPs, Ultra Short term bond funds and Short term bond funds follow this strategy.

If an investor needs a steady return from his Debt portfolio and is not ready to take higher risk he should invest in Accrual based funds.

DURATION BASED STRATEGY

The funds which follow the Duration based strategy invest in long term bonds and benefit from the fall in interest rates. They earn from capital appreciation along with the coupon of the bond. These funds are exposed to interest rate risk and if the interest rates move up these funds bear capital losses. All long term Income follow the duration based strategy.

These funds are advisable for investors who can ride with the volatility associated with the fund. The Funds can generate better return in a time when the interest rates are set to move downwards.

How to Decide?

Since each of them carries its own risk, an investor can also adopt a combination of both the type of funds in his debt portfolio as per his risk profile. An accrual strategy fund, if pursued too aggressively, may lead to an increase in credit-risk in the portfolio.On the other hand, a duration strategy can face an interest rate risk or a risk of volatility if the call of interest rate movements of the fund manager goes wrong, etc.

Therefore, both the strategies have their own merits and have a different risk-reward proposition for the investor. An Investor can also adopt a combination of both the type of funds in his debt portfolio as per his risk profile.

Importance of Credit Rating in Debt fund selection:

The credit rating represents current opinion of the respective agency regarding credit risk of debt fund schemes. These rating cn be used to assess the creditwortiness of INR denominated debt obligations. You may use these to draw a relative comparison among competitive debt fund schemes.

The rating scale used to assign rating depending upon the duration of the particular scheme. You may find a long term scale for open ended schemes. The same scale is used for close ended scheme having maturity of more than a year.

You may refer to short term scale to analyse close ended schemes having the maturity of less than one year. Remember that the ratings assigned are very dynamic in nature. These may change based on market developments.

What are liquid Funds in debt category?

Debt Mutual Funds that predominantly invest in debt securities with short term maturities, that yield fixed returns are known as Liquid Funds. These debt securities comprise money market instruments such as treasury bills, commercial paper, certificates of deposits with maturity period up to 91 days. The fundamental advantage of investing in liquid funds is the high liquidity they offer. Liquidity refers to the degree of how quickly an asset can be bought/sold and converted to cash.

LOW RISK IN LIQUID FUND

Liquid funds like all mutual funds involve investment risk, including the possible loss of principal. Investors should be aware of the risks and potential for losses associated with liquid fund investing.

The investment portfolio of liquid funds consist of short term money market instruments. The highest maturity of any invested security is 3 months, which effectively protects the portfolio from interest rate changes having low risk.

Is Liquid Fund suitable for parking money in current market situation?

Liquid funds are meant for those having substantial idle cash and are looking for short-term investment havens. Instead of parking your surplus funds in a savings bank account, you can invest them in a liquid fund. Excess funds include performance-based incentives, bonus, and gains selling capital assets. The accumulated corpus can be used to fulfill short term financial goals in the next 4-5 months.One can also use Systematic Transfer Plan (STPs) to use the accrued capital in a liquid fund for SIP installment in an equity fund. This strategy will generate higher returns and will help in mitigating market volatility, over a long term.

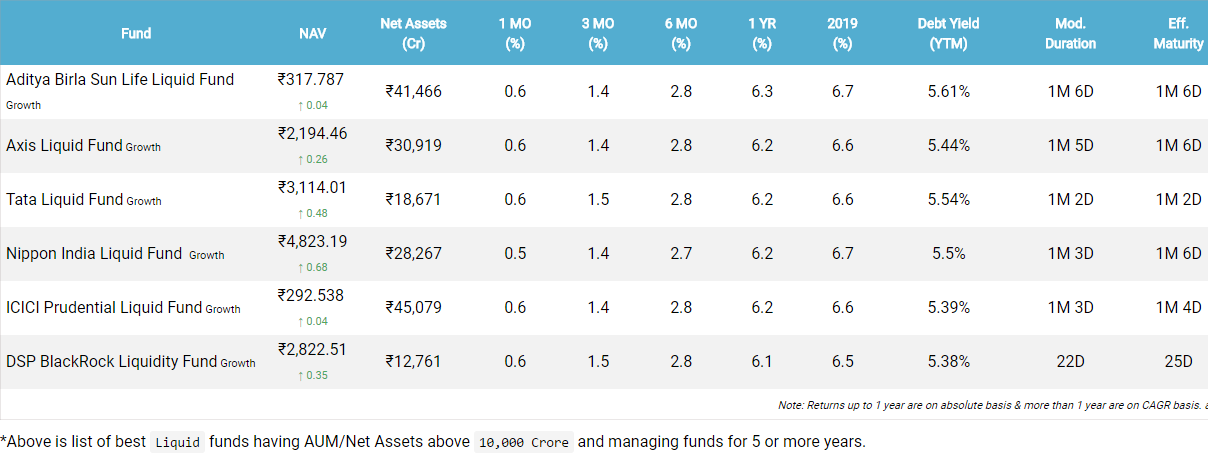

TOP 6 LIQUID FUNDS TO INVEST IN 2020:

*Data as on 1st April 2020

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment