Which is better Large cap or Mid cap?

Updated on 06-01-2020

It is often a confusing category for an investor when planning to invest in Equity Funds that should one invest in large cap or mid cap funds.

But, how large-cap and mid-cap differ from each other? Nevertheless, one good thing is— we are here to clear your confusion! So, let us first understand these terms individually and in detail.

Large Cap Funds

A large cap fund is a type of fund where investment is made in majorly with companies of large market capitalization. These are essentially large companies with large businesses. Trustworthy, reputable and strong are three adjectives that are often used to describe a large-cap company. These are the old and well-established players with a track record. Such companies typically have strong corporate-governance practices, and have generated wealth for their investors slowly and steadily over a long term. These corporate houses are usually among the most highly followed and well-researched on the market. Large cap stocks are also commonly referred to as blue chip stocks.

Being seasoned players, the underlying companies in the portfolio of large-cap funds may be considered as relatively steady compounders and regular dividend payers. On the risk-return spectrum, large cap funds deliver steady returns with relatively lower risk, compared with mid- and small-cap funds. They are ideal for investors with lower risk appetite. So, adopt a long-term perspective, stay patient, and remain invested to reap good returns over the long term.

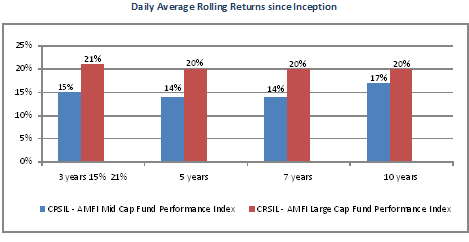

As can be seen in the graph below, large-cap funds have given better returns over a long term.​​.​

Chart: Daily average rolling returns since inception - CRISIL-AMFI Large-cap and mid-cap cap fund performance indices

Mid Cap Funds

Mid-cap funds invest in mid-sized companies. Stocks held in mid-cap funds are the companies that are still developing. During a bull phase, mid-cap stocks may outperform their large-cap counterparts, as these companies seek to expand by looking out for suitable growth opportunities. These are mid-size corporate that lie between large and small cap stocks. They rank between the two extremes on all important parameters like company size, client base, revenues, team size etc.

Mid-cap equity funds are advised for investors with a higher risk tolerance than large-cap investors. So, invest in these schemes if you seek higher capital appreciation, also w​ith reasonably higher risk.​​

Market Capitalization: Large Cap vs. Mid Cap

Large caps are shares of well-established companies that have a strong hold on the market and are usually considered as safe investments. They are companies that have a market capitalization (MC= no of shares issued by the company X market price per share) of more than INR 10,000 crore. Mid caps could be companies with a market capitalization of INR 500 Cr to INR 1000 Cr.

From a standpoint of the investor, the Investing period of mid-cap funds should be much higher than large-caps due to the nature of the companies.

Investing Benefits: Large Cap vs. Mid Cap

- Companies that invest in mid-cap have more potential for growth than large-cap.

- Mid-cap funds often tend to outperform large cap funds.

- Large companies are well-established which means that they have more consistent income. That is why the greatest benefits that large cap stocks have in their favour is the stability they can provide to one’s investments.

- Large cap funds are less volatile than mid-cap funds.

- During the downturn in the market/business, investors flock to large cap firms as they are a safer investment.

Investment in the large and mid-cap funds can also be done via Systematic-Investment Plan (SIP), wherein a fixed sum is invested in funds at regular intervals, which averages out the cost – buy more units when the Net asset value (NAV) falls and less when the NAV rises – thereby reducing the volatility across market cycles.

Best Large Cap Funds on a 5-year return basis:

|

FUND NAME |

5 YEARS RETURN |

|

Axis Blue chip Fund – Growth Large-Cap Fund |

12.13% |

|

Mirae Asset Large Cap Fund – Regular – Growth Large-Cap Fund |

11.90% |

|

Reliance Large Cap Fund – Growth Large-Cap Fund |

10.77% |

|

HDFC Top 100 Fund – Growth Large-Cap Fund |

10.61% |

|

ICICI Prudential Blue chip Fund–Institutional Option I–Growth Large-Cap Fund |

10.42% |

Best mid Cap Funds on a 5-year return basis:

|

FUND NAME |

5 YEARS RETURN |

|

Canara Robeco Emerging Equities Fund-Regular Plan |

31.21% |

|

Mirae Asset Emerging Blue chip Fund-Regular Plan |

30.94% |

|

L&T Midcap Fund |

30.70% |

|

Aditya Birla Sun Life Pure Value Fund |

30.35% |

|

Edelweiss Mid Cap Fund-Regular Plan |

29.35% |

Investors need to determine their mid-term & large term goals and build their portfolio accordingly. Your financial goals create a big impact on kind of investments you make. So, invest smartly!

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment