WHAT TO DO IF MUTUAL FUNDS ARE UNDERPERFORMING?

Updated on 13-02-2020

We invest in mutual funds expecting good returns. And even as most mutual fund schemes continue to outperform their respective benchmarks, there are some which grossly underperform, even after long holding periods.

People continue to stay invested in underperforming schemes either out of lethargy or in the hope of their turnaround. Investors need to shed this attitude because it can significantly harm their financial health and should choose mutual funds considering the category average return and not that of the best-performing schemes.

Investing regularly is only one part of building wealth, monitoring your investment is the crucial other part. This is where most long-term investors go wrong. Long-term investing doesn’t mean that you have to hold the same mutual fund scheme for a very long time. So, monitoring your portfolio and taking remedial actions on a regular basis is crucial to long term wealth generation.

Now the question arises, how to identify the underperformers in one’s portfolio? Should a fund’s performance be measured relative to its benchmark or relative to the category average?

GIIS Financial Experts say that investors should focus more on the benchmark. If the scheme is beating its benchmark comfortably, and if it goes below the category average for few quarters, it is not a big concern.

Investors should use category average carefully, especially for the multi-cap category. Investors also need to be careful about the profile of a fund within a particular fund category. For instance, both Franklin India Blue Chip and SBI Blue Chip fall under the large-cap category. However, while Franklin India Blue Chip is benchmarked against Sensex and is truly a large-cap scheme, SBI Blue Chip is benchmarked against BSE 100 and has leeway to investment in mid cap stocks.

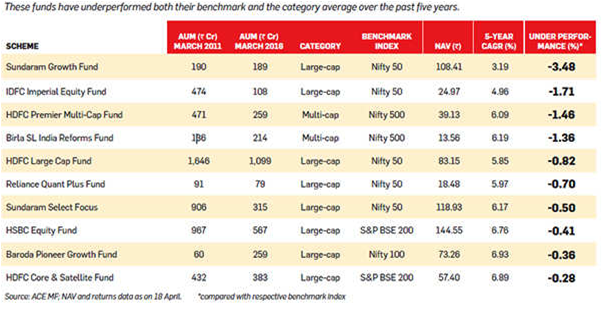

FUNDS THAT HAVE UNDERPERFORMED

GIIS Financial Experts suggest that one should do their annual portfolio review. Investors should get alerted if their scheme is underperforming significantly (by 2-3%) for the past one year. Investors don’t need to dump all underperformers in one year though. Underperforming schemes should be monitored on a quarterly basis.

You can take help from GIIS Financial Advisor and probe deeper. Investors also need to keep a close watch on the events likely to impact fund performance—fund manager changes, fund house’s acquisition, etc.

Most of the underperforming schemes are from the large-cap category. Alpha generation (generating returns better than the benchmark) from the large-cap segment has become very difficult now, but alpha generation continues in the mid-cap segment. Most underperforming schemes have low AUM; their high expense ratio may also be an issue. So, investors should concentrate on reasonably large schemes, preferably the flagship schemes of a fund house. Most fund houses give more attention to their flagship schemes. So we advice our clients to focus their core investments with flagship schemes.

To generate wealth, it is important that investors monitor their portfolio regularly and replace the underperformers with better schemes.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment