How One can Create Wealth through SIP?

Updated on 30-01-2020

“Wealth is like sea-water, the more you drink, the thirstier you become.”- Quavo

Creating wealth requires financial discipline and a long-term horizon for investing. Savings is the First step in creating wealth however it is the smarter way of multiplying your savings by investing it in the right avenues for a secure future with realistic goals.

For example say if we tell you that an amount as little as Rs 500 a month can go a long way in building wealth? What if we told you there was an investment option that can get you great returns?

Then Systematic Investment Plan (SIP) is the one you should go for. Instead of waiting for large amount you can easily start smaller and regular investments through the Systematic Investment Plan.

Systematic Investment Plan (SIP) enables you to make fixed investments in mutual funds periodically (monthly or quarterly).SIP helps you to save regularly and thus accumulate wealth in a disciplined manner for long-term, thereby providing better returns.

SIPs are ideal for investors who don't have the market expertise and a big lump sum to be invested immediately or the time to constantly monitor their investments. Through SIPs, you can easily apply the power of compounding on your investments and build a sizeable corpus over time.

Here we have some of the Benefits of SIP:

- Flexibility of investment amount-One of the main benefits of the SIPs is it provide flexibility in choosing the amount you want to invest and you can choose your frequency on daily,weekly,fortnightly or monthly basis.

- Generate through power of compounding -SIPs allow investing small amounts systematically over long periods of time can accumulate a sizeable corpus for investors through the power of compounding.

- SIP is convenient for clients-Another benefit of SIPs is that it is convenient as once you set up your SIP, the amount is automatically debited from your bank account each month, ensuring that a structured investment is made consistently. In other words, you simply set it up and allow it to run on an auto pilot mode.

- Flexibility of tenure-SIPs also provides flexibility to choose the tenure according to their own requirement and suitability where they can stop and increase or decrease the SIP amount any time. There are no penalties for missed SIP payments.

- Benefit of rupee cost averaging-SIPs allow you to invest in the ups and downs of the market. However the amount invested in SIP is fixed with the help of rupee cost averaging the investors can buy more units when market share price is low and lesser units when market share price is high.

Time is the key factors in compounding as the longer you remain, the more profits you can accumulate. This is a virtuous cycle and creates enormous power of compounding.

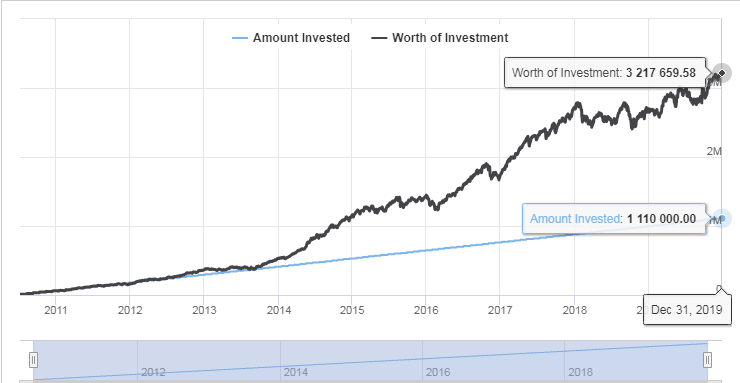

Illustration of how to create wealth through SIP:

Illustration that tells you about the benefit of consistently increasing the value of your SIP and how it impacts the final returns.

MIRAE ASSET EMERGING BLUECHIP FUND-REGULAR-GROWTH

.png)

From the above graph we can see clearly that a person who starts his monthly investment of Rs.10,000 on 1st Jan 2010 and continues till the 31st Dec 2019 gets a return of Rs. 32,17,659.58 by investing total of Rs.11,10,000 which shows how value of SIP consistently increases and affects the final return leading to wealth creation.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment