Nippon India NFO for Multi Asset Fund: Open till 21st August

Updated on 14-08-2020

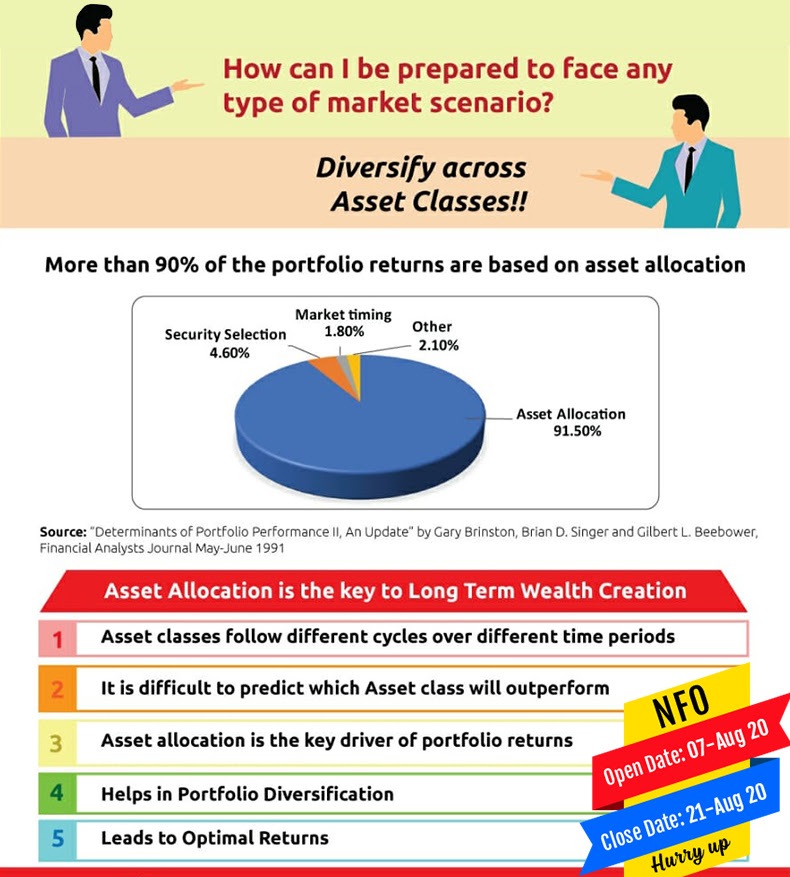

Nippon India AMC (formerly known as Reliance Nippon Life AMC), has launched a New Fund Offer (NFO) for a Multi Asset Fund .This NFO is an open-ended scheme which will invest 50% of its assets in Indian equities, 20% in international equities, 15% in commodities and the remaining in Debt & Money Market Instruments. The NFO of Nippon India Multi Asset Fund has been opened on August 7 and will remain open till August 21.

The primary investment objective of Nippon India Multi Asset Fund is to seek long term capital growth by investing in equity and equity related securities, debt & money market instruments and Exchange Traded Commodity Derivatives and Gold ETFs.

As per SEBI a Multi Asset Fund is a scheme which invests in at least 3 asset classes with a minimum allocation of at least 10% each in all 3 asset classes.

The NFO is having both Growth and Dividend options along with two variants i.e. Direct plan and Regular Plan. The minimum investment allowed in the scheme is Rs 5,000 and in multiples of Re 1 thereafter.

Other Details on the NFO are below:

|

Name of the Fund |

Nippon India Multi Asset Fund |

|

Type of Scheme |

An open-ended scheme investing in equity:: domestic and overseas, debt and money market instruments and exchange-traded commodity derivatives and Gold ETFs |

|

Equity category |

Multi Asset Fund |

|

Benchmark |

50% of S&P BSE 500, 20% of Crisil Short Term Bond Fund Index & 30% of Thomson Reuters – MCX iCOMDEX Composite Index |

|

NFO Dates |

Opens on August 07, 2020 Closes on August 21, 2020 |

|

Fund Manager |

Manish Gunwani and Ashutosh Bhargava- equity Kinjal Desai- overseas Amit Tripathi- fixed income Vikram Dhawan- commodities |

|

Minimum Application Amount/Minimum Purchase Amount |

Rs. 5000 and in multiples of Re. 1 after that |

|

Minimum Additional Investment |

Rs 1,000 and in multiples of Re 1 after that |

|

Minimum Redemption Amount |

Rs 100 or any number of units |

|

Entry Load |

Nil |

|

Exit Load |

1%- If redeemed before the completion of 1 year from the date of allotment |

|

Plans |

Regular Plan and Direct Plan |

|

Options |

Growth and Dividend Option |

We believe it is important for investors to have a foot in every major investible asset classes, multi-asset allocation strategy will reduce portfolio volatility and provide stability and also ensure optimal returns for your long term financial objectives.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment