NFO of Principal Large Cap Fund : Open till October 12.

Updated on 06-10-2020

Principal Asset Management has launched a NFO of Principal Large Cap Fund, an open-ended equity scheme predominantly investing in large cap stocks.

The NFO is open for subscription and will close on October 12, 2020.

The scheme will allocate 80-85% of its corpus to the top 100 Indian large cap stocks by market cap and actively invest up to 15% in US stocks with a market cap higher than USD 50 billion. The large cap fund aims to provide growth from Indian and US economies and depreciating currencies.

“Principal Large Cap Fund is the first large cap fund in India that will enable investors to widen their investment horizon and tap into the investment opportunities provided by Large Cap Indian and US companies, especially those who are expected to emerge stronger from the changing economic landscape and have a higher growth and comparatively lower risk quotient. A globally diversified portfolio will help investors to take advantage of market cycles in two different economies and partake in the returns of the companies in the US, while also trying to mitigate the country risk," says Bharat Ravuri, Managing Director, Principal Asset Management.

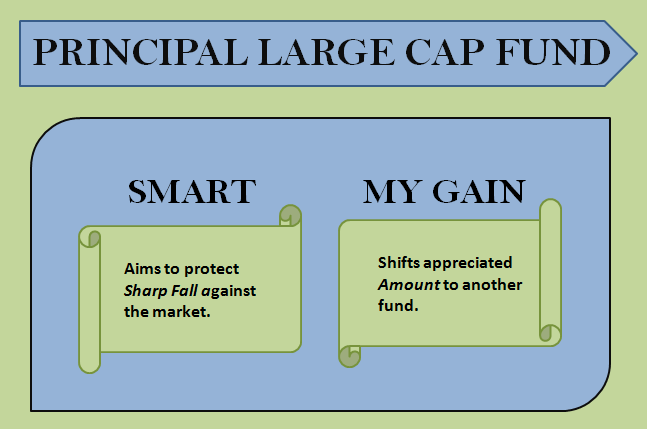

The Principal Large Cap Fund offers two facilities - SMART & My Gain. SMART aims to protect investors against a sharp fall in markets as it invests in a staggered manner to mitigate risks from timing the market. My Gain facility allows investors to set a target rate of return and automatically shifts the appreciated amount to any Principal fund of their choice, when the target rate is achieved.

The fund is benchmarked against the composite index of Nifty 100 Total Return Index NIFTY100 TRI.

Minimum Application Amount:

- New Investor Rs. 5,000/- for both Dividend and Growth Option and any amount thereafter under each Plan/Option

- SMART - Rs. 25,000/-

- Systematic Investment Plan: Minimum twelve installments of Rs. 500/each

- Systematic Transfer Plan: Minimum Six installments of Rs. 1,000/each

- Regular Withdrawal Plan: Minimum Six installments of Rs. 500/each

If redeemed/ switched on or before 365 days from the date of allotment:

- Nil for redemption/switch out of unit’s upto 24% of the units allotted (the limit).

- 1% on redemption in excess of 24% of the limit stated above- Redemption of units would be done on First in First out Basis (FIFO) Nil thereafter.

The fund is suitable for investors who are seeking long term capital Growth by investing predominantly in equity and equity-related securities of large cap companies.

Here are few funds of Principal with their past performance:

|

SCHEME |

NAV |

1 YEAR RETURN |

|

Principal Small Cap Fund- Regular Growth |

11.96 |

26.27% |

|

Principal Global Opportunities Fund- Regular Growth |

32.33 |

14.64% |

|

Principal Balanced Advantage Fund- Regular Growth |

21.60 |

6.47% |

*NAV & Returns as on 5th Ocotober 2020

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment