HDFC Asset Allocator Fund of Funds NFO

Updated on 17-04-2021

Creating a diversified investment portfolio across various asset classes such as equity, debt, Gold etc can offer optimal balance of risk and return. Asset allocation fund is the ideal option which provides you mix of asset classes.

HDFC mutual fund has come up with a NFO on April 16 i.e HDFC Asset Allocator Fund of Funds. The NFO is open till 30th April.

What is the fund all about?

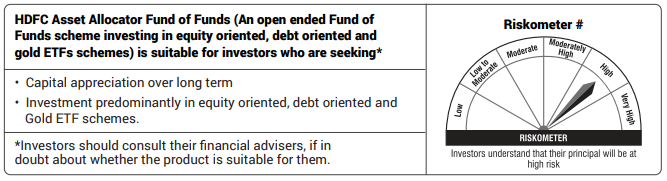

HDFC Asset Allocator Fund of Funds is an open ended scheme investing in equity oriented, debt oriented and gold ETF schemes. The Fund managers are Mr. Amit Ganatra, Mr. Anil Bamboli and Mr. Krishan Kumar Daga.

The investment objective of this fund is to seek capital appreciation by managing the asset allocation between equity oriented, debt oriented and gold ETF schemes. There is no assurance that the investment objective of the scheme will be realized.

The minimum investment amount is Rs. 5000 and any amount thereafter. It is available in both Regular Plan and Direct Plan having Growth Option and Income Distribution cum Capital Withdrawal (IDCW) Option.

The Fund is benchmarked against 90% NIFTY 50 Hybrid Composite Debt 65:35 Index (Total Returns Index) and 10% Domestic Prices of Gold arrived at based on London Bullion Market Association's (LBMA) AM fixing price.

These funds are taxed as debt funds, unless they invest entirely in ETFs. When you switch between different schemes, you may incur capital gains tax. As FoF is a mutual fund, such tax is not applicable on rebalancing its portfolio.

If you are seeking capital appreciation over long term (having a time horizon of atleast 5 years) by investing predominantly in equity oriented, debt oriented and Gold ETF schemes then you can go ahead with this scheme.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment