CONFUSED WHETHER YOU SHOULD STAY INVESTED FULLY OR MOVE INTO CASH IN THIS LOCKDOWN PERIOD?

Updated on 28-05-2020

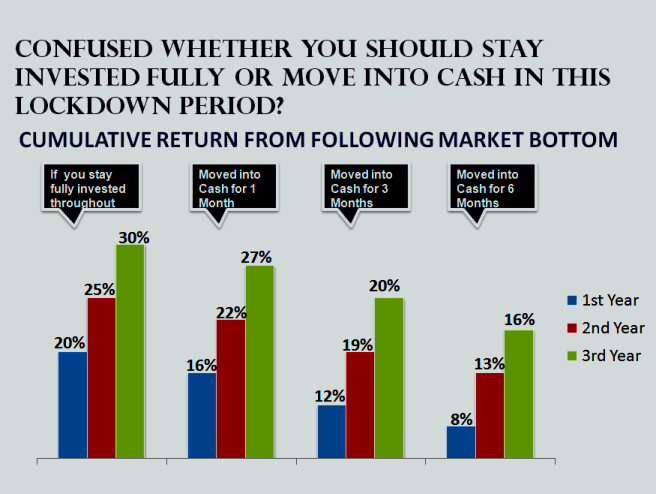

In this coronavirus lockdown everybody is confused whether they should stay invested or move into cash.

Arm yourself with your assessed risk tolerance, time horizon and your investment objective before making moves in your portfolio.

.jpg)

If you stay fully invested throughout this crisis period this will help will to achieve your desired portfolio result in future.

.png)

As in the above graph you can see that if you fully invested for the terms of three years the returns earned are as follows for the 1st year it is 20%, for the 2nd year it is 25% and for the 3rd year it is 30%.

But as some of you out of panic start moving into money and your returns are affected by it,as you can see in the graph if you have moved into cash for 1 month your return % has been reduced from 20% to 16% for the 1st year, 25% to 22% in 2nd year and 30% to 27% in 3 year and so on has taken further decrease if you kept moving into cash for 3 months, 6 months and even further.

When it comes to increase money, investors are in a fear from bear market. Even when the market recovers, they hesitate to get back onto the seat. It is only when the market recovers fully those investors realise that they missed the bus. So, the longer you remain on the sidelines, the further behind you find yourself when the market recovers.

CONCLUSION

This the time to stay invested fully through this lockdown period and you will see the reward of your risk tolerance in your portfolio.

You can use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment