A NFO that may suit you!

Updated on 12-06-2021

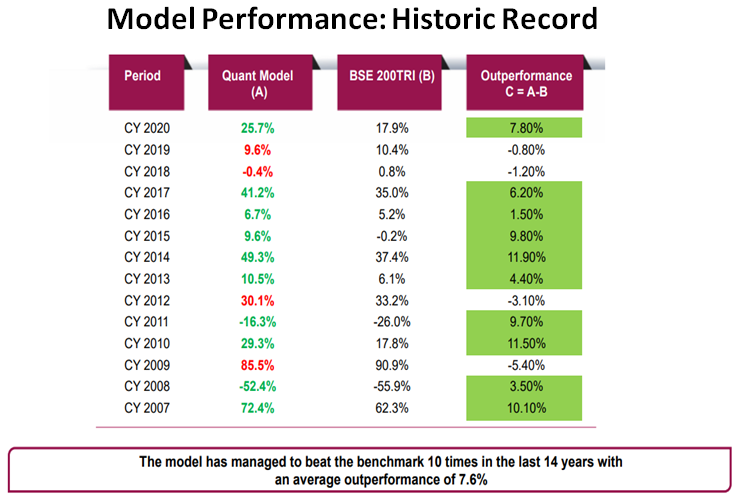

Axis Mutual Fund has launched a Quant Fund, which is an open-ended equity scheme that will invest primarily in equity and equity-related instruments selected based on a systematic quantitative process. The NFO is open and will close on 25th June.

The minimum application amount for the NFO is Rs 5,000 and in multiples of Re 1 thereafter. The fund is benchmarked against S&P BSE 200 TRI. There is no exit load if the fund is redeemed/switched out after 12 months from the date of allotment.

According to the press release, ‘Axis Quant Fund’ will follow a fundamentally driven quantitative approach to investing. This strategy through its proprietary in-house model aims to identify the strongest bottom-up stock opportunities to invest into while accounting for both risks and return prospects.

Chandresh Nigam, MD & CEO, Axis AMC says “The landscape of active equity investing has evolved and markets are becoming more efficient. While introducing new fund offers in the market, our constant aim has been to provide investors with a product basket that suits their needs and helps them in diversifying their portfolio, allowing them to make long term allocations. The launch of Axis Quant Fund is our attempt to continue that journey for investors by offering them a product that can use the power of data to create long term wealth.”

Why invest in Axis Quant Fund?

The key reasons to invest in the fund are:

- Diversified portfolio across sectors and market capitalization

- A unique proposition of a fundamentally driven quantitative approach

- Unbiased approach to portfolio management

- Aims to outperform across cycles

The fund is suitable for investors to diversify their existing portfolio of funds and aim to allocate for the long term. The fund offers a unique proposition, combining the power of fundamentals with disciplined risk management.

You can also use GIIS Financial tools or Our Android App for Investment, tracking and Asset allocation planning.

*Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Share On

0

Comment